February 28, 2007

Master Plan

February 27, 2007

Stewart

New Jersey moved another step closer Monday to allowing the Port Authority of New York and New Jersey to buy the leasehold on Stewart International Airport, New Windsor, to ease congestion in the region’s skies and airports.

The plan was cleared by an Assembly committee Monday and can now be considered by the full Assembly. It was approved by the Senate on Thursday.

The Port Authority plans to acquire a 93-year lease on the airport from National Express Group PLC of United Kingdom. It has an understanding with the company it will pay $78.5 million to acquire the lease.

About 300,000 passengers used Stewart last year, and early signs show passenger traffic could triple this year, but transportation officials said it could handle 1.5 million and ease pressure on LaGuardia, John F. Kennedy International and Newark Liberty International airports.

Those airports handled more than 100 million passengers last year, a total projected to reach 150 million by 2025. Lawmakers also hope the plan could ease corporate jet congestion at Teterboro Airport.

The legislation would match New Jersey law with New York law to authorize the Port Authority to buy or build two new airports — one in each state — outside the agency’s district, which extends 25 miles out from the Statue of Liberty.

Also required for the deal to go through are approvals by the Federal Aviation Administration; New York state, the owner of Stewart; and a formal contract between the authority and National Express. A spokesman for the authority said last week the various approvals need to be in place before the contract can be signed, but the target of October for an actual takeover is still intact.

February 26, 2007

PILOT ? Reconvene Task Force!!

The key to the whole task force was that Representative Leary, who did an excellent job, brought people in from CEO for Cities who brought in reports on how other cities work with their non-profits, in particular Pittsburgh. After a few months, we came out with a really good report on how we could maximize the assets (monetary and intellectual) on the non-profits in the the City of Worcester. Amongst the many recommendations was that we should have an agency dedicated solely to these efforts.

Recently I have read about the PILOT issue being brought up again by some of the councilors. As a result I decided to check out the agency that was created by our task force the UniverCity Partnership. I got to tell you that I was rather disappointed. Although I have not heard of many of our recommendations being implemented, I was hoping that I have read something different. Quick can anyone tell me who heads this Partnership??? If you want, you can check out the report here.

If you want to see how this is suppose to be working check out the City of Pittsburgh's University Partnership or the Providence Plan. Instead of going down the PILOT road again, maybe we should reconvene the task force and take a look at our original recommendations and see how we have done so far?

February 25, 2007

15 Coppage Drive

The original lease contained an option to renew the lease for two additional twenty year terms , assuming that the terms of the original lease were complied with. One of the terms was that real estate taxes must be kept current. Last year when this lease was renewed the property was not current and the today the tax bill stands at $191,000. I also question as to how a three year sub-lease, violation of the lease, was executed to Thermalcast in December of 2004 that was not approved by the Airport Commission until November (check the board minutes), another violation of the lease. By the way there are even more violations.

Putting all of that aside why am I writing on this today? In the real estate section today, there is an auction dated for March 9th for 15 Coppage Drive advertising the leasehold interest remaining. I assume the successful bidder will only have to pay the City of Worcester $12 per year for the 12 acres through 2026. I also then assume that the successful bidder will have an option to exercise the last 20 year renewal in 2026 for the same $12 per year.

Who is in charge of renewing the lease? I do not think it it the City of Worcester but the Airport Commission, I need to double check this. Last year the lease clearly should not have been renewed and today at the very least we should take steps to end the lease since the terms (back taxes being current) are not being complied with.

If the City of Worcester is facing a budget crisis, which I believe that they are, and need to cut two fire engines, I guess that is what we have to do. It really bothers me, however, to see:

- leases renewed at $12 per year when real estate taxes, now at $190,000, are not paid

- permitting fees, ironically also about $190,000, are waived for the Performing Arts Center, which in the end will pay no property taxes as a non-profit.

- union station tenants that do not pay rent

- investments like $7,000,000 in a SkyBridge, which if not enough "net new" taxes are raised will cost the taxpayers of Worcester.

February 24, 2007

Airport Goals

Targeted Leisure Airlines

1. Allegiant Airlines: December 22, 2005 1st flight --September 3, 2006 was their last flight.

2. USA3000

3. Apple Vacations: partner of USA3000

4. Festival Airlines start-up based out of Rockford with a similar business plan as Allegiant.

5. SkyValue:

6. Skybus

Shuttles to a Major Hub

1.JetBlue to JFK on their Embraer 190

2.Colgan Air, US Air, to LaGuardia

3.Mesa Air, Delta Connection, to JFK

Very Light Jets

1.Linear Air

Start-ups

1.Festival Airlines

2.Skybus

3.CQ Air

February 23, 2007

Stewart International

February 22, 2007

JetBlue

1) JetBlue's hub is in NY. All they need to do is provide daily jet service to and from Worc to New York. From there you would be able to connect with direct flights around the country.

2) JetBlue is doing this already in Rochester, Syracuse, Burlington and Buffalo

3) JetBlue is looking to do this also into Manchester, NH and Portland, why not Worcester, the third largest city in New England?

4) JetBlue has a relationship with MassPort and we may be able to “leverage” this relationship to get JetBlue to fly into Worcester.

5) JetBlue's target market is smaller markets like the Worcester

6) JetBlue recently has made a sizable investment in a fleet of jets with 100 seats to service smaller markets like Worcester.

7) JetBlue is innovative and aggressive and may be the type of airline to give Worcester a chance.

8) JetBlue could get naming right to our empty airport or even the Centrum.

9) JetBlue can tap into a large market of college students who fly home, retirees who go to Florida and a Latino population that travels to Puerto Rico and the Dominican Republic.

Some three years later JetBlue has made a huge commitment to Boston with numerous daily flights to their hub at JFK as well as many direct flights throughout the country. Most recently we have even seen JetBlue start a code-sharing agreement with Cape Air to feed Boston. Why were we not included in this??

During the summer of 2004, Tom Moore even called the strategic flight planner, Dave Ulmer and convinced him to visit ORH. We have had JetBlue on the radar screen for three years, had the strategic flight planner visit ORH, have spent over $200,000 on a consultant to recruit/retain an airline and missed a code-sharing agreement between Cape Air/JetBlue.

Recently I flew to Tampa. Between the drive time and out-of-pocket expense (80) I would have paid 149 round trip on Cape Air between ORH-Boston to get on a JetBlue flight to Tampa. Imagine how much easier it would be to check in at ORH on a Cape Air flight!!!

February 21, 2007

MassPort to Increase Cargo

The Massachusetts Port Authority will develop a new port plan that outlines additional facilities, land and transportation infrastructure needed to support the growth of Boston’s cargo and cruise ship operations through 2025. The agency is looking for a consultant to help assess further expansion possibilities and financing sources for its South Boston maritime facilities. “We’re looking for a strategic plan that will look at global economics regarding world trade,” said port director Michael Leone said. “It’s imperative that we develop the infrastructure, water depth, roadway system and container handling space to meet this increase in trade.”

Massport has seen 6 percent to 9 percent annual growth in container cargo operations for the last three years. “We expect that growth to continue, and we expect some of the growth to be coming from trade that will be moving into South China and the Indian subcontinent and into the U.S. East Coast through the Suez Canal,” Leone said.

Massport is increasing the cargo-handling capacity at the Conley Container Terminal by 50 percent under a two-year project that will be finished this summer, but more capacity will be needed to handle future growth. The Massport Marine Terminal also is being redeveloped as a cargo warehouse and bulk cargo facility.

February 20, 2007

DCU Special District Finance Zone

The bill authorizes the City of Worcester to borrow up to $30 million to finance the construction of the “sky bridge” and upgrades to the DCU Center. The initial loan order recommended by the manager initially authorizes $5.125 million in bonds to be issued for the $7 million sky bridge project. The balance ($1.875 million) of the financing for that project is already part of the city’s Five-Year Capital Improvement Plan. How does the City of Worcester pay this back?

The special district designation allows “net new” state tax revenues, such as meals and sales taxes, collected at those establishments to be redirected to the city. The state will continue receiving existing tax revenues from establishments in the special district financing zone, but it will dedicate the "net new" revenues from that zone to the city so it can repay the loans that are taken out for the sky bridge project and improvements to the DCU Center.

Two things can happen.

1. First the DCU Special District Finance Zone will do additional business and the "net new" state tax revenues collected will be redirected to the city, pay the notes and cost the city tax-payers nothing.

2. Second the DCU Special District Finance Zone does no do any additional business and does not create any "net new" state tax revenues. In the later case the note would have to be paid back so I would think it would come out of the City's general fund.

All I am saying is that there is some risk here. In fact Mr. O’Brien emphasized that the loan authorization limits any further capital improvements to proceed beyond the first allotment of $5.125 million. He said further work would be dependent upon the revenue-generating success of the DCU Special District Finance Zone. The loan authorization requires the city manager, with the assistance of the city treasurer, to report to the City Council on revenues generated by the special district, to demonstrate that they can financially support additional capital improvements beyond the first allotment.

In the end the questions is will these investments create the additional "net new" state tax revenues to pay the notes thus not cost the taxpayers of Worcester?? Reminds me of buying stock on margin. If the stock goes up, you can make some great returns. On the other hand if the stock drops, you get a margin call.

Harry Tembenis Letter to the Editor

Friday, February 16, 2007

City fleet could run on used vegetable oil

| | |

|

Regarding an editorial, “Green light / City’s alternative-energy plan is timely” (Telegram & Gazette, Jan. 31), while the city should be commended for being proactive on the “green front,” there was a key alternative-energy technology missing which could greatly help a current hot-potato (no pun intended) issue affecting the city and the restaurateurs in the city: the mandated, expensive installations in restaurants and other food establishments to keep fats, oils and grease (or FOG) from clogging up the sewer system.

A Massachusetts-based company called GreaseCar has the technology available for engines to run on used vegetable oil. If the city were to convert some or all of its fleet of vehicles then it would have an unlimited supply of fuel from the city’s restaurants and hence would take the burden off of the sewer system.

By this act alone the city sends a loud, clear message to the alternative energy sector that Worcester wants to be a major player in this evolving field and is “open for business” both in utilizing such technologies and welcoming the jobs that will be created by such emerging technologies.

HARRY TEMBENIS

February 19, 2007

Land RFP

Basically there are no utilities provided. The successful bidder needs to provide their own utilities at their own cost. I have no idea where the closest water and sewer line is but this can end of cost a ton of money not to mention other utilities.

Just do not see how anyone can bid on this.

Airport Director

Now do a search for "Eric Waldron" or "Worcester Eric Waldron"? Other then a high school wrestler in New Jersey, our airport director is non-existent. Even after Allegiant pulled out of Worcester, I never saw one comment from our airport director.

After a new management team is in place maybe one of the first things we should do is find out what Chuck Seliga future will be, now that Stewart is being taken over by the Port of New York and New Jersey.

February 18, 2007

January, 2007 Board Minutes

- Amity is renting a mobile office and not the office in the hangar space, why is this?? Remember we have been told the conditions are deplorable. Are they so bad that they can not use the office space and now need to go to the mobile office, which I imagine is a trailer.

- Looks like Mr Nemeth is also beginning to wonder why we are paying so much money to IMG.

- No mention on how IMG is doing with their "two"packages for the two airlines that they are working on to recruit and retain.

- No mention as to status of the MassPort negotiations.

JetBlue

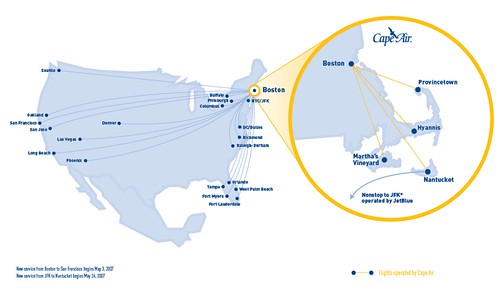

Beginning March 19, JetBlue and Cape Air customers will be able to take advantage of a codeshare that will connect JetBlue flights to Boston with Cape Air flights to Hyannis, Nantucket, Martha's Vineyard, and Provincetown, all in Massachusetts.

The partnership is a big deal for JetBlue, because involves codesharing, interline baggage, and frequent flier points redemption on another airline for the very first time. This certainly appears to be a test for the airline, and if it does well I'd expect to see more.

Sort of lost in the shuffle but still a nice move is the announcement that JetBlue will fly nonstop on Embraer 190s from New York/JFK to Nantucket from May 24 through September 24. They're really going to take advantage of the summer season there, and it seems like a smart move. Personally, I'm still bitter that I didn't win the limerick contest sponsored by Nantucket Airlines (owned by Cape Air), but I'm trying to forgive and move on.

February 17, 2007

Rockford Targets 250,000

It’s getting more crowded at the Chicago/Rockford International Airport, but officials hope it doesn’t feel that way. The airport had its second straight month of 17,000 passengers in January, the first time it’s done that in a year and a half. The 17,041 passengers that flew in and out of Rockford this January is an 86 percent increase over the previous January, a strong first step in the airport’s goal of 250,000 passengers this year.

To deal with growing numbers, the airport continues to improve its terminal. Two new escalators will be operational by the end of the month, the restrooms are being renovated, and there are plans to double the number of courtesy phones, expand the security check-in area and open a self-service restaurant.

“We knew we needed to do additional things if we want to sustain our image as a hassle-free, low-cost, high-value alternative,” airport Director Bob O’Brien said. “We have to be working across so many fronts — that means chasing airlines as well as satisfying passengers. This is the satisfying passengers part.”

Meanwhile, airport officials are discussing long-term planning issues, including expansions of the terminal. The building can comfortably handle between 500,000 and 750,000 passengers, numbers that officials hope to top in the next few years.

Mike Dunn, chairman of the Greater Rockford Airport Authority board, said last month that topping 250,000 passengers this year is a realistic goal, though officials think they can draw as many as 300,000.

This year started out much stronger than last — by the end of January 2006, Northwest Airlines had left town and Rockford had only two routes. Now there are five routes. The most popular were to the Orlando and Tampa Bay areas of Florida, which each topped 4,500 passengers. Dunn said January is historically a down time for travel, so the sharp increase in passengers is noteworthy. February is projected to top 17,000 passengers also, again strongly beating 2006’s numbers.

O’Brien said keeping passengers happy comes down to little things as well as big ones. The new escalators will make it easier for passengers to get to and from the upstairs boarding areas, while the expanded security area will keep people from backing up onto the escalators.The redone restrooms will have hand-sanitizer dispensers, separate sinks instead of the large shared sink and paper towels to complement the dryers.

The airport will also remove its last pay phone this year and at least double the handful of courtesy phones available for local calling. “People go, ‘It’s free?’ Yeah, it’s free,” O’Brien said. “People think it’s a nice touch.”

February 15, 2007

15 Coppage Drive

I never understood how the lease could be extended when one of the terms of the initial lease was to be current on real estate taxes. Right now the tax balance is $190,602. Assume if BankNorth, or someone else, is to take control of 15 Coppage via the auction, they are able to assume the renewed lease at the same terms , something like $1,000 per year, until February, 2026.

RFP's

There has been a concerted effort to advertise and attract qualified developers from across New England,” Mr. O’Brien said. In an effort to reach a broader audience, Ms. Jacobson said the RFP has been advertised in the Boston Herald, New England Real Estate Journal and Banker & Tradesman, in addition to the Telegram & Gazette and Central Register.

I commend the City of Worcester on these efforts, but only wish the same marketing effort had been put into ORH.

February 14, 2007

136 Days

- 136 days left in the current operating agreement. MassPort is a done deal--long-term lease at a nominal amount with an option to renew with some revenue sharing.

- why are we trying to put these two parcels of land out for RFP now with so much uncertainty?

- A St Pete's flight from Allegiant out of ORH would not only have attracted Tamps fliers, but Fort Myers and other popular destinations on the Gulf Coast like Naples, Port Charlotte, etc

- Assuming the current $70,000 goes to IMG, we will paid them approximately $270,000!!! We would have been much better off juts writing a check to Allegiant keeping them here and hitting 10,000 passengers, which means 1,000,000!!

- Can I say it again for the 100th time.. Losing Allegiant was a huge loss.

February 13, 2007

January Board Minutes

Or any mention in the board minutes as to how IMG is doing in their recruitment efforts to date?

IMG

We then spent another $100,000 to retain them to help us retain and recruit an airline. To date all I know is that they put together two packages, but have no idea to whom or how it went.

Now they another $70,000 to

- advise the city which airlines could be successful at ORH. Let me get this straight we have paid them over $200,000 and they still do not know which airlines would be successful at ORH.

- hire another company to do route analysis for top ten markets. We have spent $200,000 and have not done this yet.

Lets forget about the first $100,000 that we paid for the report. Can anyone tell me exactly what we got for the second $100,000 before we spend another $70,000 on IMG???

City Council Meeting

- How is IMG doing on their recruitment efforts, specifically what happened with the two airlines that "packages" were being prepared for?

- Why are the January Board Minutes still not on the airport web site?

- How exactly has the Department of Transportation Grant monies been spent?

- If we are not, why are we not talking to the other potential suitors for ORH other then MassPort?

- Why are we putting the 2 parcels of land out for RFP now when the future management of ORH effective 7/1/7 is not known?

- Has Coordinates Corp, the subject of the November 2006 Board Meeting, moved their jet and the 5 full-time employees (as explained in the Board Minutes) to ORH yet?

- When will the results of the Master Plan be released?

- Does anyone care at the airport about the deplorable conditions at ORH that have been reported on this blog at some of the City owned facilites?

February 12, 2007

Avports

Currently, AvPorts provides airport management services at Albany International Airport (ALB), Atlantic City International Airport (ACY), Republic Airport (FRG), Teterboro Airport (TEB), Tweed New Haven Regional Airport (HVN) and Westchester County Airport (HPN). All of the airports managed under contracts with AvPorts are certificated by the federal government under Federal Aviation Administration (FAA) safety standards.

Stewart Again

Stewart-Port deal firms up | |

Stewart Airport – The Port Authority of New York and New Jersey any day now hopes to be signing its deal with National Express to buy the remaining 93 years on the lease to operate Stewart Airport in Newburgh. When the Port announced its plans last month, it said the deal should be signed by mid-February. The bi-state agency also said it would name a company to run the airport for it on an interim basis until a more long-term selection could be made. While the Port said no company has been chosen yet, industry sources point to AvPorts as the leading contender. Based in Baltimore, Maryland, the company is no stranger to the northeast US area. It currently manages Albany International Airport, Atlantic City Airport, Republic Airport on Long Island, Teterboro Airport in New Jersey – another Port Authority-owned airport, Tweed New Haven Airport, Westchester County Airport and the 34th Street Metroport in Manhattan. A New Jersey Assembly committee last week approved the purchase of the airport; the whole Garden State legislature and governor must approve the deal, which is not expected to be a problem since Stewart is being groomed as a reliever airport for the three metro passenger jetports. The Port Authority is planning to take over Stewart in early November. | |

February 10, 2007

TF Green Buying ORH

TRENTON, N.J. -- New Jersey moved closer on Thursday to allowing the Port Authority of New York and New Jersey to buy Stewart International Airport in Newburgh to help ease congestion in the region's skies and airports. A Senate transportation panel approved changing New Jersey law to let the Port Authority to enter into a $78.5 million, 93-year lease of the airport 60 miles north of New York.

It was the first legislative approval for the plan, which still requires consent from the full Assembly, Senate and Gov. Jon S. Corzine.The Port Authority hopes to take over operations at Stewart by October. About 300,000 passengers used Stewart last year, but transportation officials said it could handle 1.5 million and ease pressure on LaGuardia, John F. Kennedy International and Newark Liberty International airports. Those airports handled more than 100 million passengers last year, a total projected to reach 150 million by 2025.

The legislation would match New Jersey law with New York law to authorize the Port Authority to buy or build two new airports -- one in each state -- outside the agency's district, which extends for a 25-mile radius from the Statue of Liberty. Bill sponsor Sen. Paul Sarlo, D-Bergen, mentioned the Atlantic City International Airport and Trenton Mercer Airport as potential purchases by the Port Authority in New Jersey, but Shawn K. Laurenti, the Port Authority's government and community relations director, said nothing is imminent.

"I don't think there's any interest in pursuing an airport in New Jersey at all," Laurenti said.

Sen. Henry P. McNamara was unconvinced that New Jersey won't need another airport and expressed concern about giving the Port Authority the ability to establish one.

"If New Jersey is going to continue to grow, the need is going to happen here also to where you're going to need something to alleviate Newark," said McNamara, R-Bergen.

Sarlo said he at least hopes using Stewart will ease congestion at Bergen County's Teterboro Airport, which has become one of the nation's busiest small airfields. Teterboro Airport has been a longtime sore spot for neighboring residents, who have complained of aircraft noise, exhaust odors and incidents involving planes running off runways.

February 09, 2007

Tampa

February 08, 2007

Tampa

Instead of flying out of ORH, I am up at 3:00AM for a drive to Boston. I will try to post some blogs.

February 07, 2007

IMG Update

"Additionally, IMG is preparing route analysis for two prospective airlines. City staff are working closely with MassPort officials to review and make additional recommendations on these packages. Following the finalization of the packages, MassPort and the City will meet with representatives of the targeted airliness to determine interest in locating at the airport."

Tonight here is the IMG update from City Council minutes:

"IMG will continue to provide the City with analysis of potential carriers and the creation of specific marketing packages and strategies for those identified airlines. The City and Massport are focusing efforts on identifying and recruiting airlines that employ more efficient aircraft and service popular destinations which were identified through the locan and FAA-conducted surveys of passengers preferences."

- Were the two packages finished?

- Were the two airlines met with?

- What did they say?

February 05, 2007

National Express

While we are at it. If the Port of New York and New Jersey is going to dish out 79$ million to buy the remaining 93 years of the lease from National Express, maybe they would want to throw a few bucks at ORH?? Airport for Sale!!! Call all the airport authorities--TF Green, Bradley and Manchester.. Lets get top dollar for ORH...

Actually I got a better idea. Lets take the money left from the Department of Transportation Small Community Air Service Grant, put together an RFP for a consultant to hold community meetings and conduct a survey to decide what we should do.

February 04, 2007

Today's Editorial

- December 12th, 2006, regarding to the Master Plans. "The action plan, scheduled to be issued in its final form early next year, charts a realistic course toward realizing the airport’s potential in the region’s air transportation network."

- November 28th, 2006, regarding the Land RFP. "The initial request for development proposals is a significant step in the right direction."

120,000

February 03, 2007

Putting the Airport out to Bid

Over the past two years on this blog, I do not know how many times we have said SELL ORH and that the City of Worcester knows how to run an airport no more then it knows how to run a Civic Center (or a hospital). Now it seems everyone agrees with us. Unlike others, who try to rewrite history, look at #13 in our list of recommendations:

13) Invite airport management companies to Worcester and review the possibility of putting together an RFP whereby we lease the entire airport to a private management company.

In fact Bob Nemeth stopped by my office last January, 2005, after the web site went live on the airport and we discussed various matters concerning the airport. I told him that we should look into privatization of ORH like Stewart had done with National Express (there is a section on the web site about it towards the bottom). Mr Nemeth did not know what either privatization or wifi (another recommendation) was, so I had to explain both to him. In the end, he told me to submit my idea to the airport commission for their review.

Take a look at the Board Minutes and hit the February,2005 minutes, check out number 7 under new business. The Airport Board minutes says thanks for the recommendation but that IMG was looking into it already. What did IMG say about privatization in their $100,000 report?? Answer: Nobody would be interested in the airport so we should forget about recommendation #13,

My question has been all along is how can IMG say that without trying? IMG , by the way, are the same guys we have paid an additional $100,000 to recruit and retain a commercial airline--how they doing on this?? As Harry Tembenis, Jahn and many others have suggested there are possibilities and what do we have to lose to try? Is there not a fiduciary responsibility to get the highest possible return for the tax-payers?

Instead of attempting to sell the airport (long-term lease or outright sale), we spent monies on consultants and surveys that one of our own airport board members, Mr Nemeth, now says was a waste of time and is getting us nowhere. Think about it, had you ever heard of Stewart International Airport in Newburgh, New York, before reading this blog?? I did not, but now you read about a 79 million dollar lease from the Port of New York??

Lets hope Bob Nemeth has a part 3 to his recent story on the airport, as to why we never looked aggressively for a buyer other then MassPort. Eventually when we lease ORH for a nominal amount to MassPort, will this be fair market value??? Don't get me wrong, I personally believe that MassPort will be a huge improvement, but what did we leave on the table??

Stewart Deal

Here are parts:

The board of the Port Authority of New York and New Jersey authorized a $78.5 million deal to assume a 93-year lease of Stewart International Airport in Newburgh, 60 miles north of the city. "We can turn that sleepy, underutilized facility into a dynamic transportation hub that will allow us to meet the incredible growth and demand for air travel," said the Port Authority's executive director, Anthony Shorris.

The Port Authority, which would explore adding more parking and a new passenger terminal, is expected to take over operations by October, pending the approval of both the Federal Aviation Administration and the state's transportation department......

JetBlue Airways Corp. recently decided it would begin daily nonstop flights to Florida from Stewart. A competitor, AirTran Airways, also has launched service to Georgia and Florida from Newburgh, and has been flying to similar destinations from Westchester County.

Gov. Eliot Spitzer gave the Stewart plan a high profile by mentioning it in his first State of the State speech earlier this month, and he reiterated his support for expanding the airport in a statement this week.

"We will continue to make major investments at JFK, Newark and LaGuardia, but eventually we are simply going to run out of room. Stewart International Airport will provide much-needed relief for our three major airports, greatly reduce delays and help us prepare for inevitable population and passenger growth," the governor said.

Unlike other New York airports, hemmed in by thick urban development, Stewart has plenty of room to expand. It sits on 2,200 acres, compared to LaGuardia's 680, Kennedy's 4,930 and Newark's 2,000.

February 02, 2007

Stewart International

Who owns Stewart? Stewart International Airport is the nation's first privatized commercial airport and operates under a 99-year lease agreement with the New York State Department of Transportation. National Express Group operates Stewart International Airport and is the United State's subsidiary of the National Express Group, PLC, in the United Kingdom. Click here to go to the National Express Group website.

The most interesting part of the story that Harry sent me is the following:

The Port Authority of New York and New Jersey last week announced a $79 million deal for a long-term lease at Stewart, which served 300,000 passengers last year. The authority wants to expand it to relieve congestion at JFK, LaGuardia and Newark Liberty International airports, and to promote economic development of the Hudson River Valley.

The authority expects to assume control of the former Air Force base by October, pending closure of the deal and bureaucratic approvals.A new exit off I-84 leading directly to the airport - already under construction - is expected to open in September. The airport is also seeking money to build an international terminal.The authority has not defined a timeline or a budget for Stewart's expansion, but says it would accommodate private jet operators, cargo haulers and passenger airlines.

$79 Million when an airport is run successfully!!! Who knows maybe the authority that owns Bradley or TF Green would see the value of ORH, but again we will never know??

SkyValue

There are few items you could buy for $1 these days: a candy bar, fries or a burger from a special menu at a fast-food restaurant. But on Sunday and Wednesday, you can add a flight from Gary to several sunny places in the United States as well.

In an effort to increase passengers flying on SkyValue USA, a $1 one-way fare is being offered on flights to Mesa, Ariz., Las Vegas, St. Petersburg and Orlando for flights leaving Gary/Chicago International Airport either Sunday or Wednesday, Feb. 7. The $1 fare is also good for flights returning from those destinations to Gary on Sunday or Feb. 7.

However, the $1 price tag is based on the purchase of a round-trip ticket. Return flights begin at $79, but could reach nearly $200 depending on the return date. Gabrielle Griswold, senior executive vice president of SkyValue, said the promotion is expected to be repeated throughout the year as the airline continues to build a strong customer base.

"We've had tremendous response, and people are very pleased with the regional airports," she said, adding that the $1 fares will be offered sporadically when flights are expected to have few passengers. SkyValue is attempting to lure customers from Northwest Indiana and Chicago, who typically turn first to Midway Airport, said SkyValueCEO Darrell Richardson in a prepared statement.

"Repeated business and bookings are so strong, we know if you try us, you'll be back," Richardson said. "Our special promotion is to attract a larger audience of passengers who may not be aware of SkyValue's affordable air service and the convenience of the Gary/Chicago Airport as an alternative to Midway and O'Hare."

February 01, 2007

Why the Land RFP Failed.

Most of this is from a prior post on December 1st when I guessed at most we would get was one bidder. I was wrong--we got none, but here goes again.

Don't get it.... We are putting out an RFP (Request for Proposal) that:

- Asking someone else to build a first class General/Corporate Aviation facility on a 4.5 acre parcel owned by ORH

- Proposer does not own property but pays a ground lease of approximately 48,000 per year for 20 years, with an option to renew the lease for 10 years

- In addition to the rent, the successful proposer will have to pay a portion of their collected parking fees and fuel flowage fees to the City of Worcester not to mention of portion of labor, parts and restaurant sales

- During course of the lease any sub-letting of the successful proposer needs to be approved by the airport commission

Here is an addition:

How can we expect anyone to invest in this when the future management structure of ORH 149 days from now (July 1st) is not known. For now we should just hold off on any RFP until the management is finalized.